Finally, the United States open up to contactless payment

Although in Europe it is well-established, the adoption of contactless payment is very late in some countries including the United States. It is thought that this trend will change in 2019. According to the Financial Times, this delay is mainly due to the complexity of the US financial market. The latter by its size, age, thousands of banks, tens of millions of merchants and its fragmented industry offers different means of payment to each one, which makes it difficult to adopt a standardization of the payment system countrywide. In 2017, according to the US Federal Reserve, US consumers made $ 6.6 million in payments by credit, debit and prepaid cards, up 8% from the previous year and just under half of total consumer spending on goods and services. Analysts believe this proportion could be even higher if the US did not lack payment networks compatible with state-of-the-art cards.

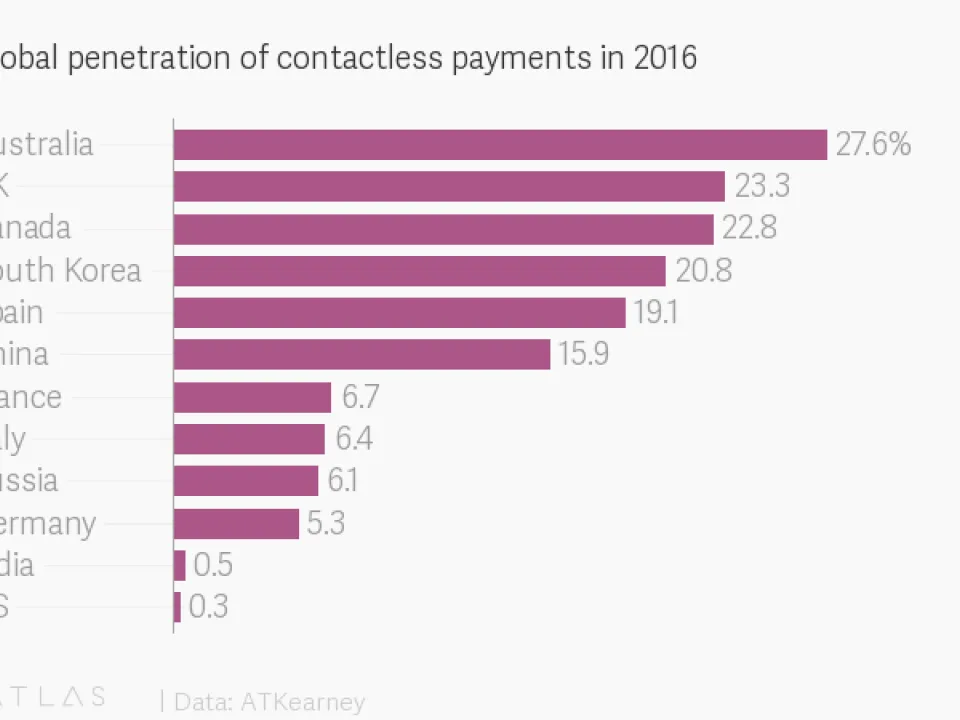

Source : ATKearney

The turning point came from Target and the massive breach in bank details by the retailer in 2013. Many American consumers used this shopping site to make purchases, hence the general awareness and the need for increased security in payment services. The crucial decision to make chips universally acceptable in the United States lay primarily in changing the rules of liability on card networks. After October 2015, merchants rather than banks became responsible for fraudulent transactions using magnetic stripe cards, urging them to update their card reading equipment and to permanently adopt smart card readers. The standardization of contactless payment is also happening in the mass transit sector. It has been announced that the Metropolitan Transit Authority would start using contactless payment in New York in 2019, which would be a huge factor of adoption according to Mr. Vosburg, CEO Mastercard North America : "When transit gets enable through contactless, usage rates go up everywhere, not just in transit, but in Starbucks, McDonald's and so on." The United States has just completed its transition to the smart card which explains their delay today in the contactless technology. However, once the smart card-enabled terminals are in place, switching to contactless will only require updating and activating traditional smart cards. This change in the means of payment opens new opportunities to bank cards' issuers and companies that provide these latest generation payment cards. According to economists, the global contactless market is expected to grow by 24% between 2017 and 2022 in particular by smartphones payment but also by contactless bank cards. Paragon ID innovates, and through its subsidiary Amatech, has launched the first metal cards in the world allowing a contactless payment on both sides of the card! Source: Financial Times